Dental care is essential for your overall health and well-being. However, dental services can be expensive and not always covered by your regular health insurance.

That’s why you might want to consider getting a dental insurance plan from Allstate, one of the leading providers of insurance products in the US.

Cost of dental coverage

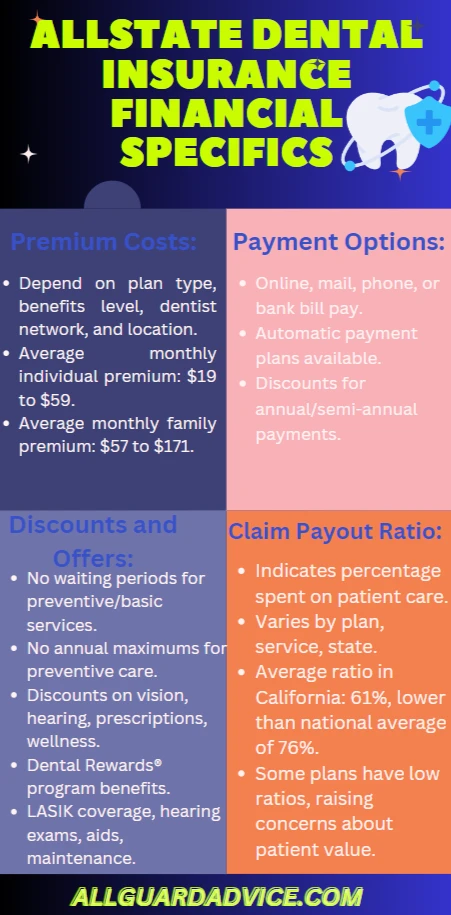

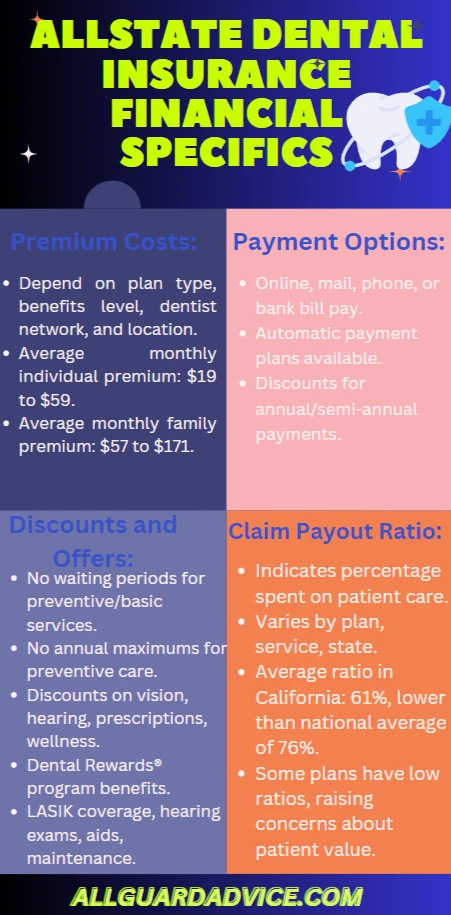

The cost of dental coverage depends on several factors, such as the type of plan you choose, the level of benefits you want, the network of dentists you prefer, and your location.

Generally, the more comprehensive and flexible the plan is, the higher the premium will be.

According to Allstate’s website, the average monthly premium for an individual dental insurance plan ranges from $19 to $59, depending on the plan and the state.

For a family plan, the average monthly premium ranges from $57 to $171.

Coverage options

Allstate offers three main types of dental insurance plans: Dental Preferred Provider Organization (DPPO), Dental Health Maintenance Organization (DHMO), and Dental Indemnity Plan.

Each plan has its own advantages and disadvantages, so you should compare them carefully before making a decision.

DPPO

A DPPO plan allows you to choose any dentist you want, but you will pay less if you visit a dentist who is in Allstate’s network.

A DPPO plan also gives you more flexibility in terms of the services you can get, as you can choose from a wide range of preventive, basic, and major dental procedures.

However, a DPPO plan usually has higher premiums, deductibles, and co-payments than a DHMO plan.

DHMO

A DHMO plan requires you to select a primary care dentist from Allstate’s network, who will provide all your dental care and refer you to specialists if needed.

A DHMO plan also has lower premiums, deductibles, and co-payments than a DPPO plan.

However, a DHMO plan has more limitations in terms of the services you can get, as you can only choose from a predefined list of covered procedures.

Additionally, a DHMO plan does not cover any services from out-of-network dentists, unless it is an emergency.

Contact details

| Category | Details |

|---|---|

| Phone Number | 855-396-4011 |

| Address | Allstate Health Solutions, P.O. Box 14020, Surfside Beach, SC 29587 |

| Customer Service | Call the phone number or use the online form for questions/feedback |

| Policy Details | Dental insurance for individuals/families, coverage for preventive, basic, major treatments, exams, cleanings, fillings, etc. Various plan types available: indemnity, HMO, PPO, preferred provider, direct reimbursement. Vision and orthodontic coverage options. More details on website. |

| Email Address | No specific email; use online form for communication |

| Fax Number | 866-427-1214 |

| Operating Hours | Monday-Friday, 8 a.m. to 8 p.m. ET |

Dental indemnity plan

A dental indemnity plan is the most flexible option, as it allows you to visit any dentist you want, without any network restrictions.

It also covers most preventive, basic, and major dental procedures, up to a certain amount per year.

However, a dental indemnity plan has the highest premiums, deductibles, and co-payments of all the plans, and it may not cover some services that are considered cosmetic or experimental.

Allstate dental benefits

Allstate dental insurance plans offer several benefits that can help you save money and improve your oral health. Some of the benefits include:

No waiting periods for preventive and basic services, such as exams, cleanings, fillings, and extractions.

No annual maximums for preventive services, meaning you can get as many as you need without worrying about reaching a limit.

Discounts on vision care, hearing aids, prescriptions, and wellness products through Allstate’s partner programs.

Access to a 24/7 dental emergency hotline, where you can get advice and referrals from licensed dentists.

Online tools and resources to help you manage your dental health and claims.

Allstate Dental Insurance financial details

Is Allstate dental worth it?

Whether Allstate dental insurance is worth it or not depends on your personal needs, preferences, and budget.

Allstate dental insurance can be a good option if you are looking for a reliable and reputable company that offers a variety of plans and benefits.

However, Allstate dental insurance may not be the best option if you are looking for the cheapest or the most comprehensive coverage available.

To determine if Allstate dental insurance is worth it for you, you should compare the plans and prices with other dental insurance providers, and also consider your dental history, current condition, and future needs.

You should also read the policy details and exclusions carefully, and ask questions if you have any doubts or concerns.

Also read; Allstate Critical Illness Insurance Explained: Coverage at a Glance

Allstate Dental Reviews for Fillings

One of the most common dental procedures that people need is fillings, which are used to restore decayed or damaged teeth.

Fillings can vary in cost, quality, and durability, depending on the material, size, and location of the filling.

According to Allstate’s website, the average cost of a filling in the US is $204, but it can range from $50 to $450, depending on the factors mentioned above.

Allstate dental insurance plans cover fillings at different rates, depending on the plan and the type of filling.

For example, a DPPO plan may cover 80% of the cost of a silver amalgam filling, but only 50% of the cost of a composite resin filling.

Allstate dental insurance plans have received mixed reviews from customers who have had fillings done. Some customers have praised Allstate for covering most of the cost of their fillings, and for providing fast and easy claims processing.

However, some customers have complained about Allstate for not covering enough of the cost of their fillings, and for denying or delaying their claims for various reasons.

Frequently Asked Questions

Is this a health insurance plan?

No, their standalone dental coverage, along with an optional vision add-on, does not substitute for health insurance.

These plans are meant to complement their health insurance, whether it’s major medical or a short-term plan, for individuals under 65 years old.

Do I need to complete an application to qualify for coverage?

Yes, you must fill out their short application, which includes questions about your health. Your answers will determine whether or not you are eligible for coverage.

Am I eligible for dental coverage?

Dental insurance from Allstate Health Solutions is available to most people, including families and individuals under the age of 65. They also offer child-only coverage as well as separate products for seniors (65+).

Is there a waiting period?

There’s no waiting period for preventive and basic services. You can start using their benefits as soon as they take effect – which can be as soon as the day after you enroll. However, there is a waiting period for major dental services (outlined in their plan).

Dive deeper into Allstate Insurance through this link